Financial Health Check

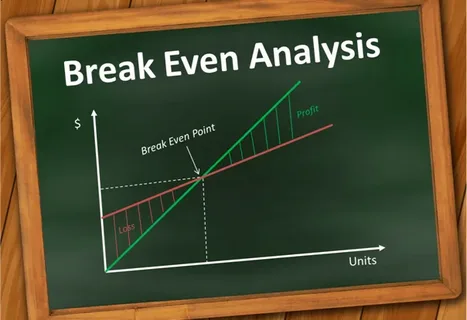

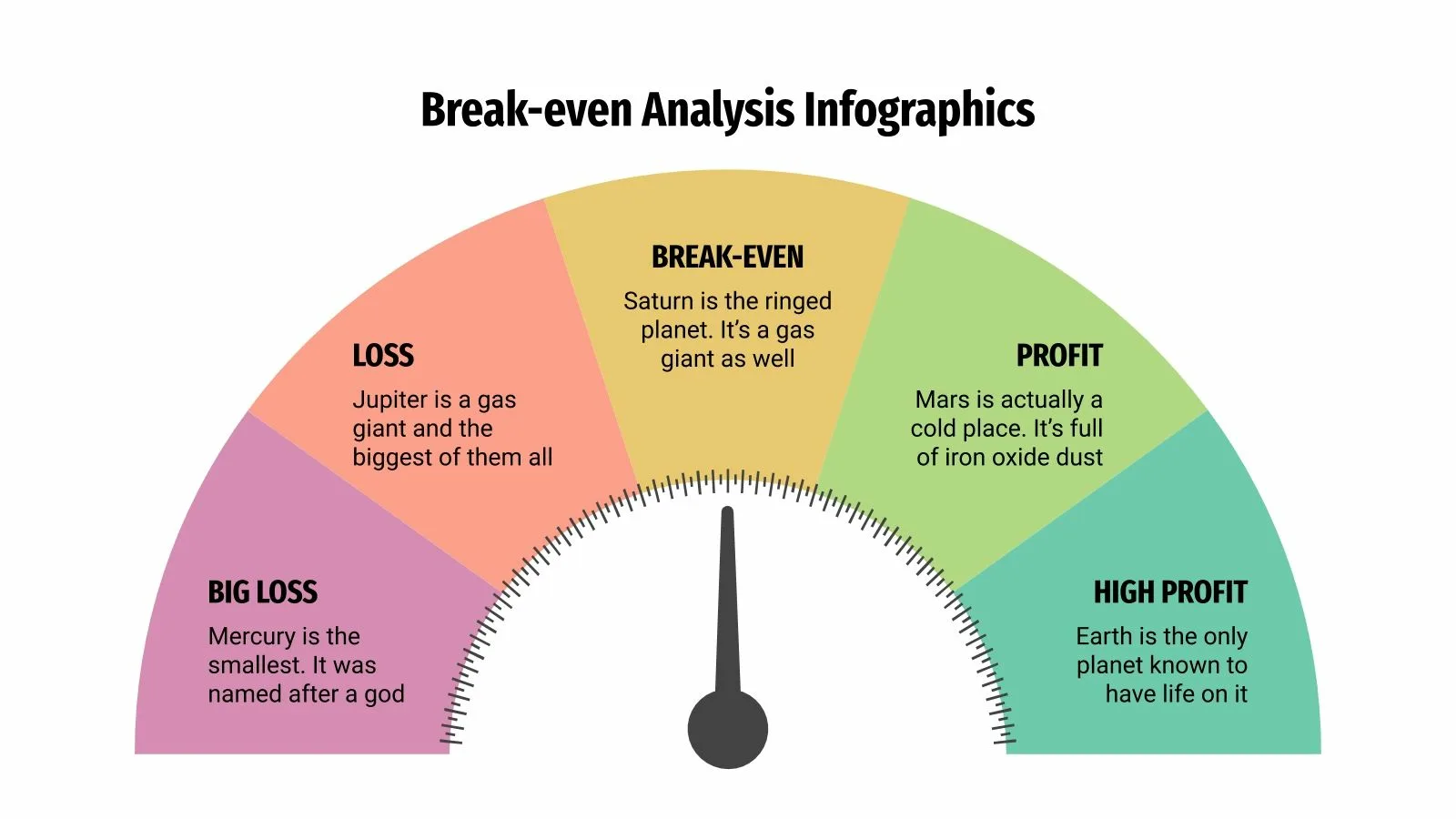

Break-even analysis for new ventures

Analyzing cash flow trends

Analyzing cash flow trends

Interpreting cash flow trends involves analyzing cash movement to assess liquidity, efficiency, and financial health. Cash flow categories include operating, investing, and financing activities, reflecting cash generation, utilization, and retention.

Consistent positive cash flow is essential for funding, debt payments, and future investments.

Interpreting cash flow trends involves analyzing cash movement to assess liquidity, efficiency, and health.

Interpreting cash flow trends involves analyzing cash movement to assess liquidity, efficiency, and health.

Cash flow is divided into operating, investing, and financing activities, showing how cash is managed.

Studying cash flow helps businesses understand patterns impacting financial obligations, growth, and stability.

Positive cash flow trends mean the company generates more than it spends, crucial for operations.

Interpreting cash flow trends enabled us to identify patterns that enhanced our liquidity and stability in the market.

Cash flow analysis revealed valuable insights into our operational efficiency, guiding us to optimize our resources effectively.

Analyzing cash flow trends helped us understand our financial health and make informed decisions for sustainable growth.